ASU 2016-14, Not-for-Profit Entities

Presentation of Financial Statements for Not-for-Profit Entities

On August 18, 2016 the Financial Accounting Standards Board (FASB) issues Accounting Standards Update (ASU) 2016-14 Not-for-Profit Entities: Presentation of Financial Statements for Not-for-Profit Entities. After 20 years, there were changes made to help nonprofits make their statements more consistent and useful to readers. See below for a breakdown of the primary changes in the ASU.

Investments

When reporting investment income, nonprofits should present investment income NET of all related external expenses—those that are reported to the organization by external money managers and other investment management firms—and direct internal expenses—those that involve the direct conduct or supervision of the strategic and tactical activities involved in generating investment return—against the investment return. With this being said, this should be presented on the face of the statement of activities. This new update has replaced the need to disclose netted amounts (except for the disclosure of the amount if internal salaries and benefits that have been presented net against investment return).

Expense Classification

Functional expenses are usually classified in a few ways:

Program services: Activities that result in goods and services being distributed to beneficiaries, customers, or members that fulfill the purposes or mission for which a nonprofit exists

Supporting services, which often include:

Fundraising: activities undertaken to induce potential donors to contribute to the organization

Membership development: activities undertaken to solicit new members and retain existing members

In the new update, all not-for-profit organizations are required to present expenses in a natural classification and by functional allocation, not just voluntary health and welfare organizations. This report can be presented in various, such as, a part of the Statement of Activities, a separate statement in the financial statements, or in the notes in the financial statements. The methods used to allocate costs between programs and other supporting services should also be disclosed in the financial statements.

Liquidity

Under the new ASU, a nonprofit’s liquid assets can be separated into two categories of information: qualitative and quantitative.

Qualitative: Nonprofits must communicate the status of liquidity and the availability of funds within one year of their Statement of Financial Position’s date, as well as identifying and evaluating these issues:

- Special borrowing arrangements or instances whereby the entity has not maintained appropriate amounts of cash as required by donor-imposed restrictions; and

- Limitations that result from contractual agreements with suppliers, creditors, loan covenants and other sources

Quantitative: Nonprofits must express the availability of unrestricted liquid assets as of the date of the statement of Financial Position to meet operating cash needs within one year of the statement date while also fulfilling these requirements:

- Assess how they manage their liquid resources to ensure they can meet their cash needs for general expenditures as of and within one year, respectively, of the statement of financial position;

- Evaluate their financial assets to determine their availability to meet cash needs;

- Consider the nature of the assets;

- Examine the external limits imposed by donors, laws and contracts; and

- Account for, analyze and track any internal limits imposed by governing board decisions

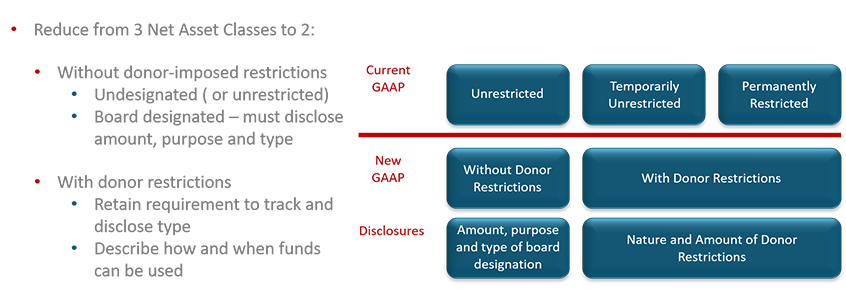

Net Asset Classification

Before the ASU, net assets were broken down into three classes: unrestricted, temporarily restricted, and permanently restricted. As of now, there will only be two classes: with and without donor restrictions. This is possible by combining the temporarily restricted and permanently restricted classes. See diagram below. With this change, there should be financial statement disclosures to indicate additional conditions including, but not limited to, particular donor restrictions, any board-imposed restrictions, and related timing considerations. Overall, the classifications are more streamlined.

Net Asset Classes

Cash Flow Statement

Under the new ASU, either the direct or indirect method for cash flow statement can be used. If the statements are presented on the direct method, the indirect method reconciliation is no longer required. The indirect method is no longer required but still permitted to use. With is approach, it encourages organizations to lean towards the direct method which in turn helps the users and makes it more understandable.

This ASU will become effective for fiscal years beginning after December 15, 2017 and for interim periods within fiscal years beginning after December 15, 2018. Early adoption of the standard is permitted. If you are a member of a non-profit organization, you should start to review the ASU and take into consideration these items so that an implementation plan can be developed.